Today, the European Central Bank (ECB) holds its monetary policy meeting, where a continuation of the status quo in interest rates is anticipated. This marks the fourth consecutive meeting without changes and with a stance of wait-and-see regarding the economy before taking action.

Special attention will be paid to the speech by ECB President Christine Lagarde, followed by a press conference around 8:45 am New York time.

Interest Rate Expectations and Inflationary Projections

According to the latest economic forecasts from the ECB, published in the December meeting:

- Estimated GDP growth stands at 0.8% in 2024, down from the previously estimated 1%.

- General inflation is projected to average 2.7% in 2024 and 2.1% in 2025.

- Price growth is expected to be 3.2% in 2024 and 2.1% in 2025.

The Harmonized Index of Consumer Prices (HICP) for February increased by 2.6%, slightly above expectations but still reflecting a retreat. Core inflation figures fell to 3.1% from 3.3% in January, confirming a downward trend.

While these data indicate a gradual decline in inflationary pressures, current economic variables suggest the need to await stabilization below or around the central banks' 2% target, as disruptions in maritime transit due to the Israel war, increased crude oil prices, wage indicators in the region, and other variables may prevent a steady decline in prices in 2024.

Therefore, Lagarde is likely to maintain her hawkish stance (high rates) until well into the summer, having a clearer view of the first half of the year and inflation and labor data for the Eurozone.

Market Reaction and EUR Dynamics

The ECB's decision inevitably influences currency markets, particularly the EURUSD pair. If Lagarde maintains a hawkish stance, emphasizing data dependence over time, the Euro could strengthen against all its counterparts. Conversely, a shift to a more flexible (dovish) stance, acknowledging softened wage pressures and hinting at anticipation in cuts, could lead to weakness in the Euro.

Technical Analysis

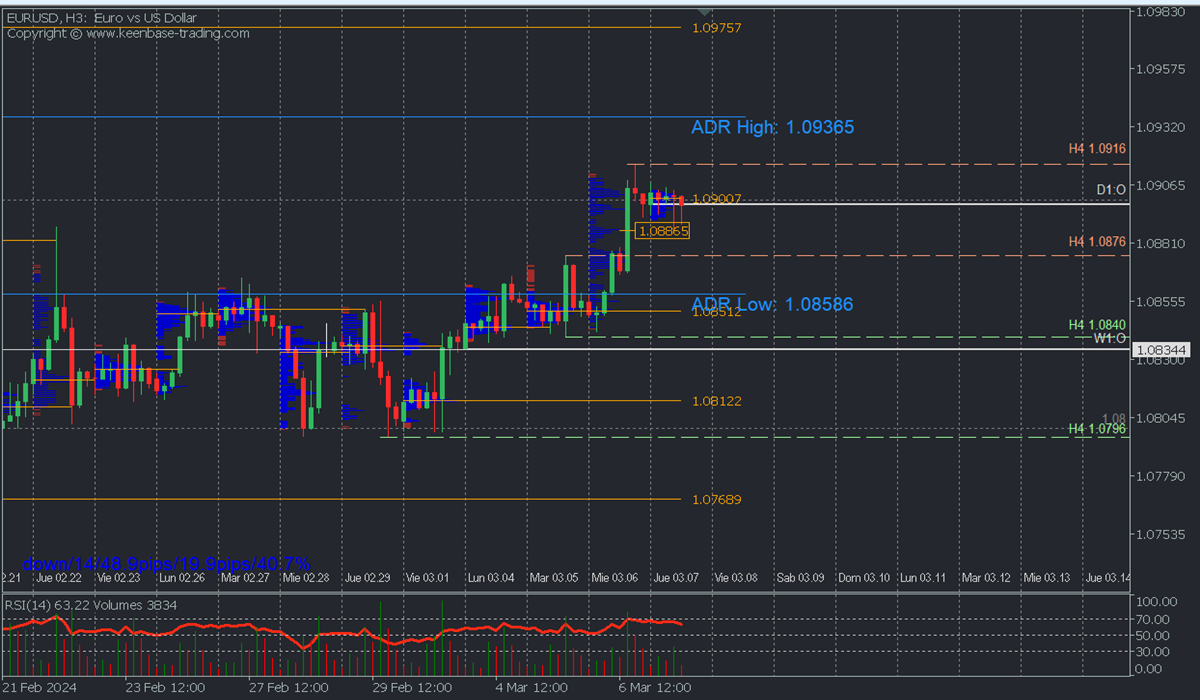

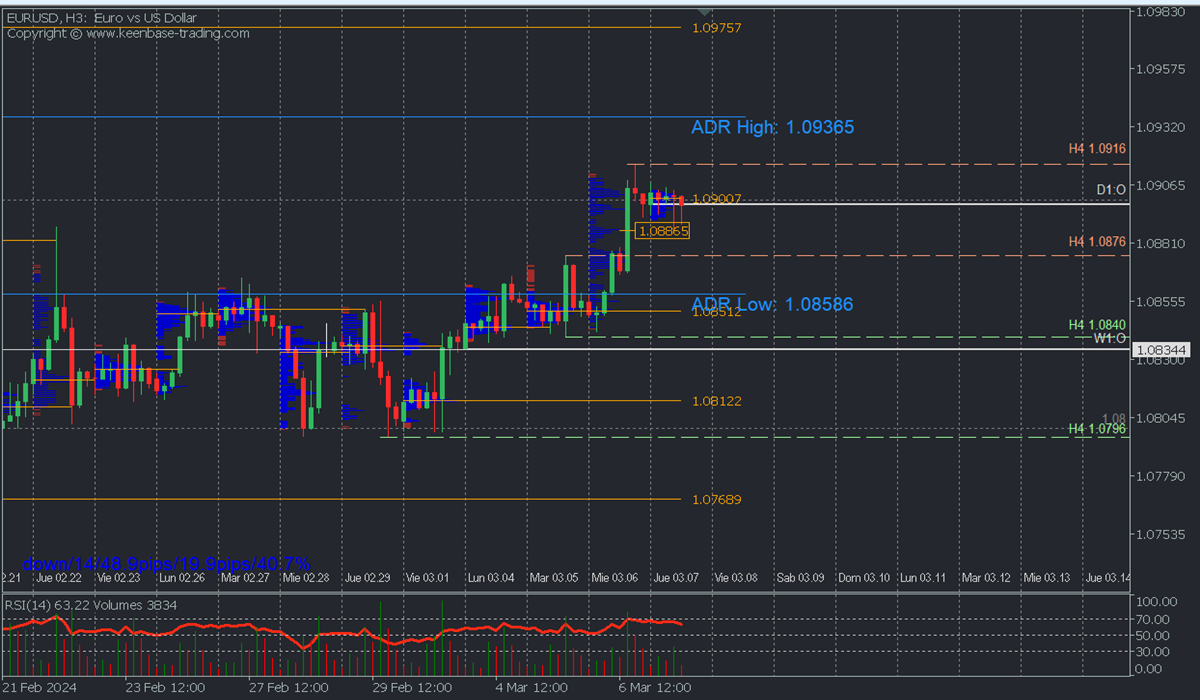

EURUSD

Daily Pivot Point (DPP): 1.09 (Sell Zone) / 1.0876 / 1.0851 / 1.0812 (Buy Zones)

It continues in an uptrend but consolidated since the day's opening and is slightly below the DPP of the early sessions at 1.09. It sought liquidity at one of yesterday's high-volume nodes at 1.08865, and breaking this zone could extend the decline towards 1.0876, both nodes with the potential to trigger purchases with a target of breaking resistance at 1.0916 and the bullish average range at 1.0936. Only if it breaks below 1.0876 can a more extended correction towards 1.0858 be expected.

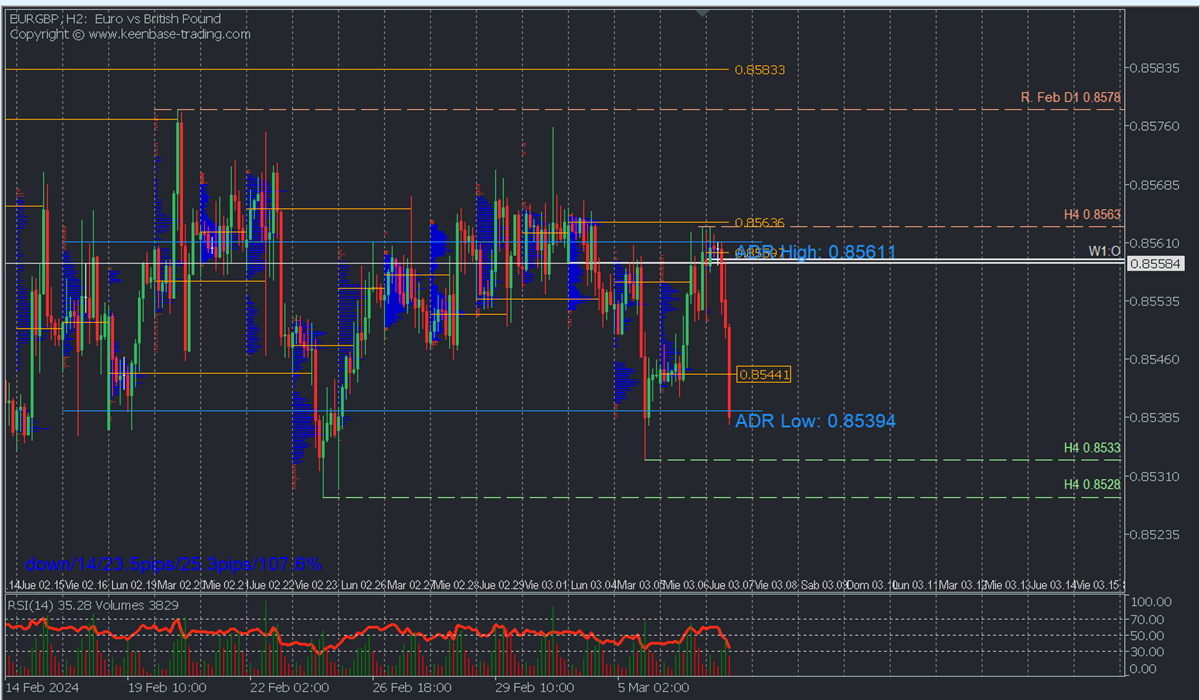

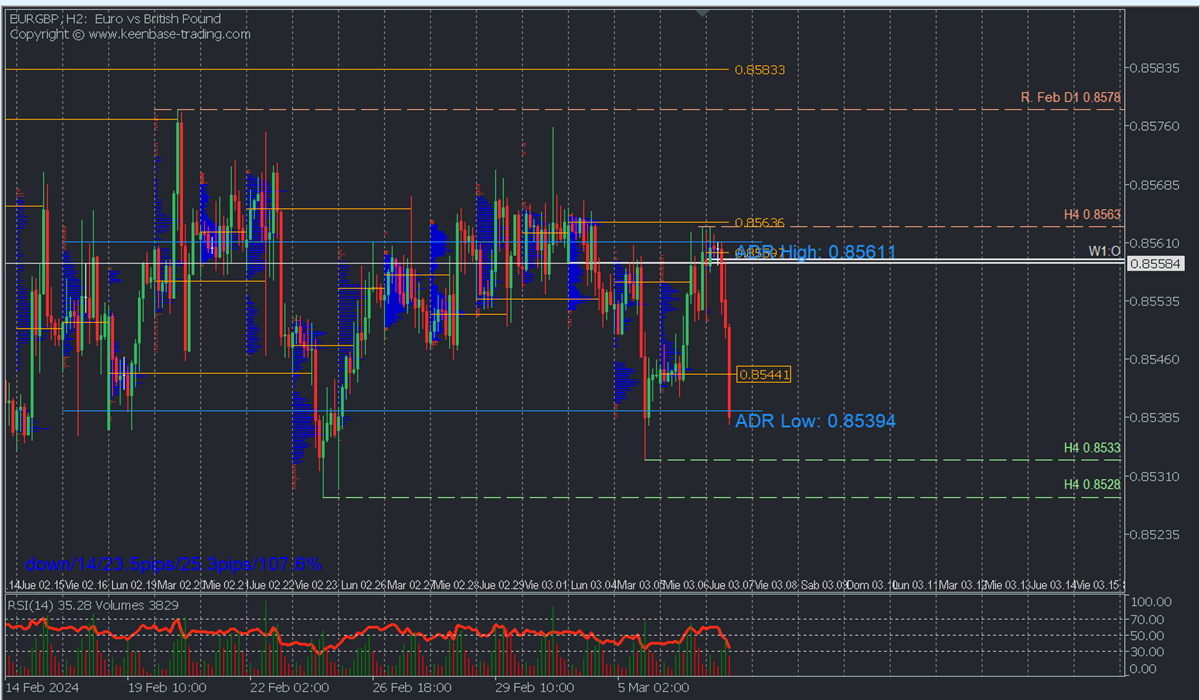

EURGBP

Daily Pivot Point (DPP): 1.8559 / 0.8563 (Sell Zone) / / 0.8544 / 1.0839 (Buy Zones)

It trades within the February range, and today, after the strong bearish opening that already reached the average selling range at 0.8539, a retracement can be expected, as we are in the macro buying zone of February, which is expected to be defended by the bulls to trigger a new rise. If prices break above the DPP at 0.8544, a bullish continuation towards 0.8550 and the day's and week's openings at 0.8558 can be expected. However, if the DPP at 0.8544 acts as a pivot and the price remains below it, more selling towards supports at 0.8533 and 0.8528 can be expected.

EURCAD

Daily Pivot Point (DPP): 1.4725 / 1.4742 (Sell Zone) / / 1.47 / 1.4675 (Buy Zones).

It shows an uptrend since February, breaking January's resistance at 1.4735, so if the current correction extends, it could seek the week's opening at 1.4675, where there is also a buying zone from Friday 1 and the daily bearish average range, after which it could renew the uptrend towards 1.48. A more anticipated bullish scenario will be activated after breaking the sell zone of the early sessions at 1.4725, targeting the bullish average range at 1.4765 and the subsequent overcoming of resistance at 1.4780.